tax on unrealized gains canada

- Capital Gains and Losses- Capital Losses Capital Losses Income Tax Act s. Capital Gains on a Primary Residence.

Capital Gains Tax In Canada 2022 Fully Explained

What is the capital gains tax rate in Canada.

. Unrealized capital gains are not taxed. August 31 2021. You can calculate as well as file for your taxes.

However the rate is generally reduced under Canadas tax treaties to 10 or 15 percent. Six Ways to Avoid Capital Gains Tax in Canada 2022. Cannabis Combining vertical industry alignment with cannabis business services in Canada and internationally.

Tax-efficient ways to withdraw money from your business. How to avoid capital gains tax in Canada when selling property Tips to minimize or eliminate your capital gains tax in Canada. Under the Canada-US Tax Treaty the rate could be reduced to 0 percent if the recipient qualifies for treaty benefits.

I had a quick question on calculating capital gains tax on the sale of a rental property. How to calculate Simply put an unrealized gain or loss is the difference between an investments value now. Filing Your Return - Stocks Bonds etc.

The good news is you only pay tax on realized capital gains. A Capital gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the 1971 Canadian federal budget. However the tax percentage is different per area.

Lets discuss this more on. If you have capital losses that exceed capital gains in the current year you can but dont have to carry back the. An unrealized capital gain occurs when your investments increase in value but you havent sold them.

Unrealized capital gains are generally not taxed except for the deemed disposition when emigrating. When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. As long as the gain is unrealized meaning the assets value has increased on paper but.

As well as this many crypto activities like staking mining and DeFi activities may be considered income and subject to Income Tax. By Danielle Kubes. 3b 1111b 1112 Capital losses can normally only be used to reduce or eliminate capital gains.

Crypto Tax Consultants and Tax Information Our CPA list contains tax consultants with cryptocurrency experience. Integrations with popular exchanges. Primary residences are exempt from capital gains.

WHT does not apply to non-participating interest paid to an arms length non-resident. They cannot be used to reduce other income. Capital gains is considered as income.

The first day on which any part of the dividend is paid. Its not all bad news the fictitious gains tax rate is low - between 054 - 158 depending on the total value of your assets - but its one of the few countries in the world to tax unrealized gains. In the Tax Information tab you will find information about the tax treatment and the legal situation of cryptocurrencies in different countries.

Dashboard tells you exactly about your unrealized gains and losses. The day on which the dividend becomes payable. We welcome your comments about this publication and suggestions for future editions.

A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the 1971 Canadian federal budget. The gains would count as unrealized while you still owned the house and realized as soon as you sold the house and became 190000 richer. The short answer to this is yes.

Heres how to calculate your unrealized gains and losses and why it may be important. Therefore it is subject to tax. In the case of Canada only 50 of the capital gains profit is taxable.

CDA consideration can be given to undertaking an internal sale of company assets that have unrealized capital gains. 119 An election to pay a capital dividend should be filed on Form T2054 by the earlier of. It helps you to integrate automatically with exchanges to gather your data.

This means that if youve made 5000 in capital gains 2500 of those earnings need to be added to your total taxable income. The withholding tax rate may be reduced if the dividend is paid to a person that is resident in a country that has a tax treaty with Canada. In other words until you lock in the gain by selling the investment its only an increase on paper.

You can keep track of your capital gains and trading performance. Divide your gains and losses into short-term gains and losses from investments. They can help you to check your tax return and file it correctly.

Heres the drill to figure out the tax results. NW IR-6526 Washington DC 20224. 75k or would the profit be calculated on the difference post land transfer legals closing costs etc.

How are capital gains taxed in Canada. If I bought for 250k and sell for 400k would I pay the tax on 50 profit of the 150k difference ie. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

The domestic rate of withholding is 25 percent. Do You Pay Capital Gains Tax in Real Estate Sales.

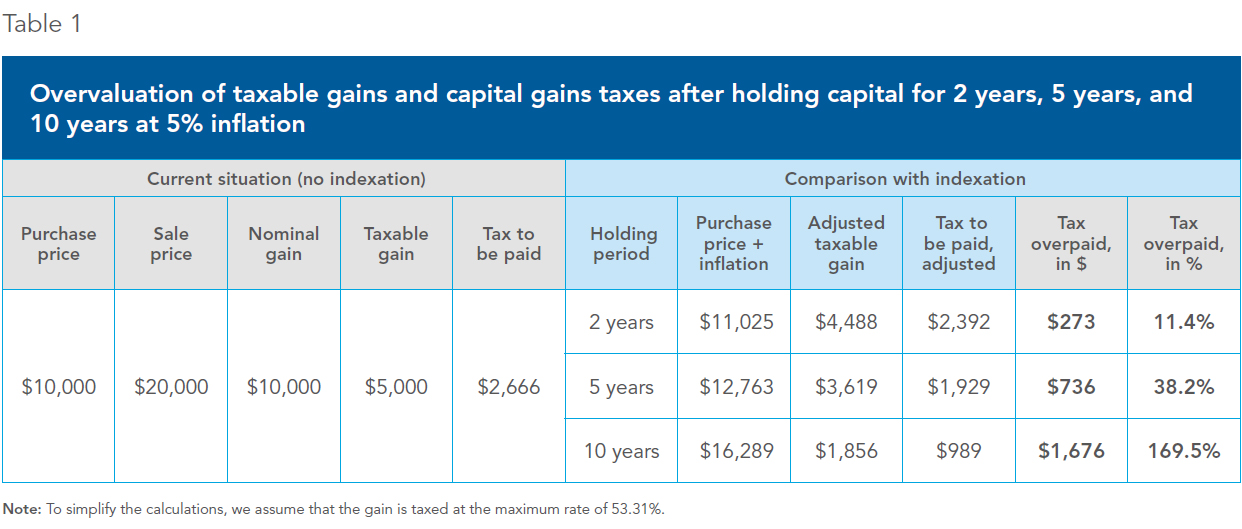

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

Capital Gains 101 How To Calculate Transactions In Foreign Currency

Capital Gains Tax In Canada 2022 Fully Explained

Is It Time To Reexamine Your Corporate Structure Corporate Tax Canada

Capital Gains Taxes And The Democrats Downsizing The Federal Government

Average Effective Tax Rates Excluding Corporate Tax On Retained Download Table

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

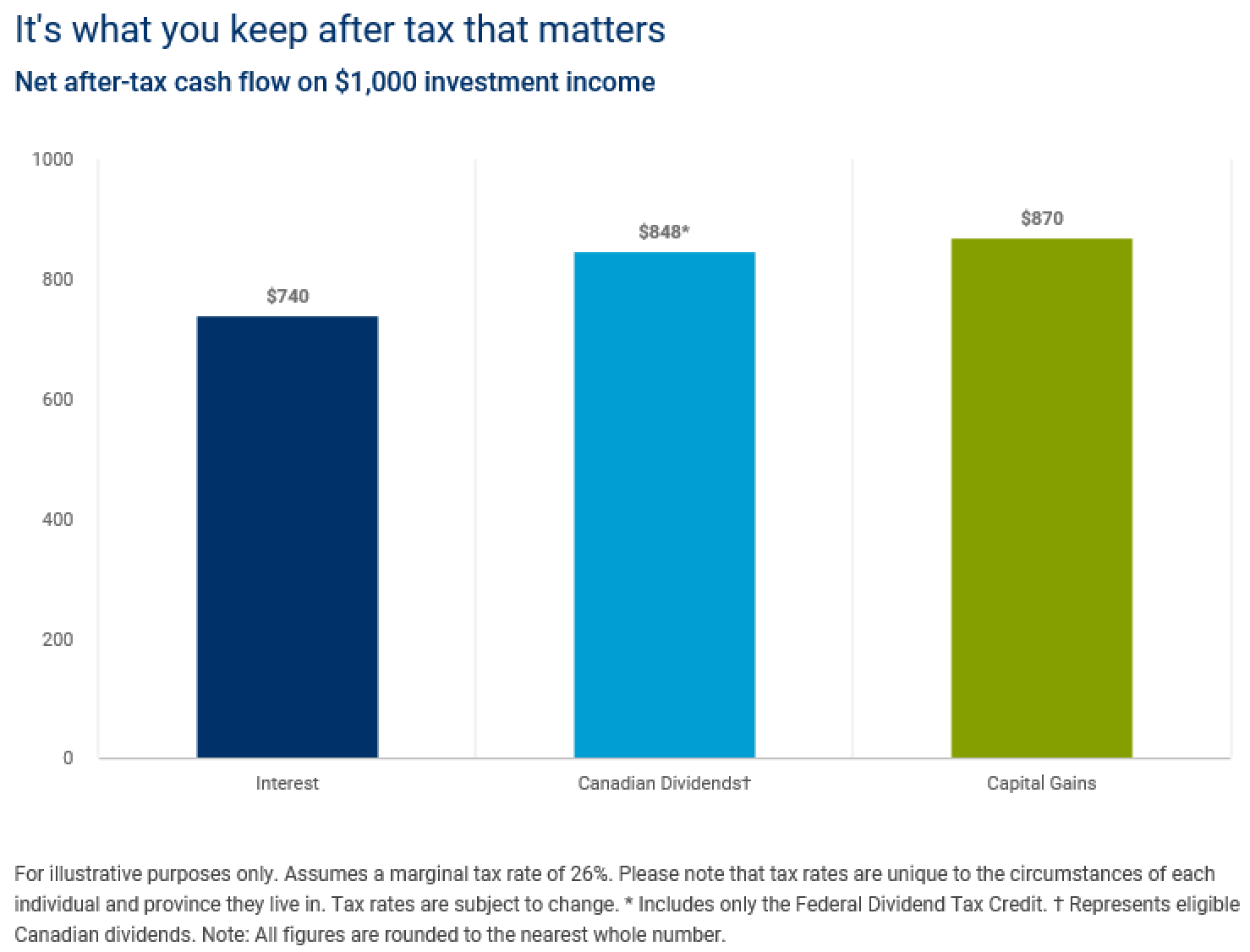

Understanding Taxes And Your Investments

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Capital Gains Tax In Canada 2022 Fully Explained

Whitehead Wealth Management Blog 11 Non Registered Accounts And Taxes

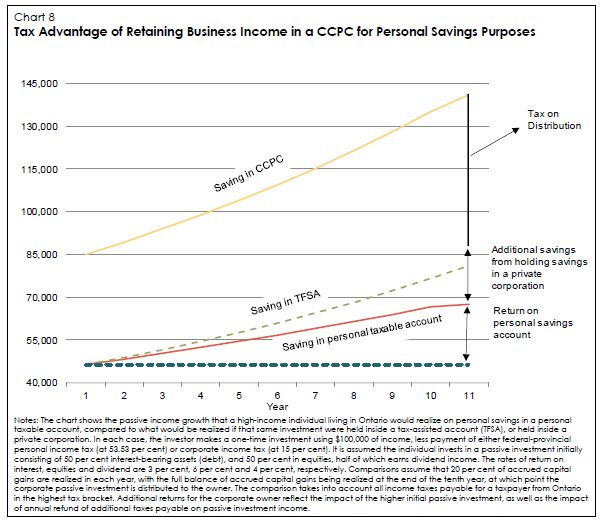

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada